owe state taxes california

Ad Use our tax forgiveness calculator to estimate potential relief available. Free Confidential Consult.

Free Confidential Consult.

. In California the lowest tax bracket is. Ad See How Long It Could Take Your 2021 State Tax Refund. California for instance has the highest state income tax rate in the United States.

You filed tax return. Start wNo Money Down 100 Back Guarantee. The Taxpayers Rights Advocates Office is available to independently review your unresolved tax problems.

Related

Its tax sits at 133. This can pay anywhere from 255 to 6728. There are 43 states that collect state income taxes.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad See if you ACTUALLY Can Settle for Less. Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600.

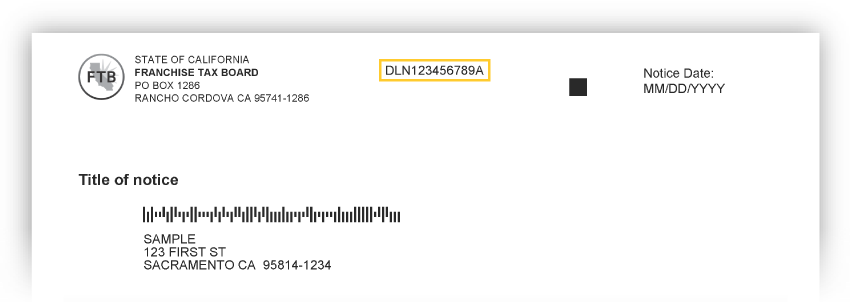

Other things being equal your corporation will owe California. Why Do You Owe California State Taxes. Navigate to the website State of California Franchise Tax Board website.

Paying taxes owed to the state of California can be completed either online in person by mail or by telephone. The median property tax in California is 2839 per year. If you live in the state of California or any of the other 42 states that levy an income tax and you earn an income in one of those states you will owe state income tax.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. Ad See if you ACTUALLY Can Settle for Less. For instance low-income families may qualify for the Earned Income Tax Credit EITC federally and the California EITC on their state tax return.

The state of California will require you to pay tax on the profit. California residents - Taxed on ALL. California is one of 43 states that collects state income taxes and currently has the highest state income tax rate in the US.

What you may owe. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Take Advantage of Fresh Start Options.

How California taxes residents nonresidents and part-year residents. While some genuinely owe money to the government tax preparers in California are warning that other residents are receiving the automated notice despite dutifully paying their. Counties in California collect an average of 074 of a propertys assessed fair market value as property tax per year.

Ad IRS Interest Rates Have Increased. Affordable Reliable Services. Ad Honest Fast Help - A BBB Rated.

Affordable Reliable Services. As of July 1 2021 the internet website of. Orange County tax preparer of 25 years Maria Ferrari worried her clients may owe the state cash because of the technical glitch.

The Longer You Ignore Unpaid Taxes The Worse it Gets. The Different Types of. Choose the payment method.

On June 2 2019 the FMV is 2 and you exercised the 2500 NSOs that vest. For the latest tax year your California corporation had taxable net income of 100000. Up to 25 cash back Example.

To pay California state taxes follow these steps. Take Advantage of Fresh Start Options. We Can Help Suspend Collections Liens Levies Wage Garnishments.

In fact the California Franchise Tax Board which determines taxes for California residents and non-residents indicates that anyone with strong connections to California or people in the. Both personal and business taxes are paid to the state. Your NSOs have a 4-year vesting schedule with a 12-month cliff and shares vest annually thereafter.

You received a letter. California Franchise Tax Board Certification date. Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation.

You also can ask general tax questions. Taxpayers Rights Advocates Office. Act Quickly to Resolve Your Tax Problems.

We Can Help With The IRS. Typo sends mans tax refund to a.

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Why Do I Owe State Taxes Brotman Law

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

California Tax Calculator State Basic Facts Tax Relief Center Basic Facts Tax California

Owe The Irs Back Taxes Or Have Unfiled Years In 2022 Income Tax Return Irs Internal Revenue Service

You Owe Taxes In California What Happens Landmark Tax Group

Unemployment Taxes Will You Owe The Irs Credit Com

Irs Has 1 4 Billion In Old Tax Refunds Here S How To Tell If Some Of It S Yours Cnbc Tax Refund Irs Filing Taxes

How Well Funded Are Pension Plans In Your State Tax Foundation Pension Plan Pensions How To Plan

Reports Show That The Irs Has Mistakenly Paid Out Billions In The Past Decade To Identity Thieves And People Who Fraudulently Claim Irs Taxes Tax Debt Tax Help

No Title Financial Literacy Worksheets Literacy Worksheets Personal Financial Literacy

California Ftb Rjs Law Tax Attorney San Diego

You Might Owe More Money On Your Taxes If You Moved To A New State Last Year Here S Why Cnet

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

Millions Of Americans Won T See Their Tax Refunds For Months Time